Wheat Consumption in Pakistan:

Wheat consumption per capita in Pakistan is amongst the highest in the world at around 124 kilograms per annum. Population growth in conjunction with the consumer preference for wheat-based products is expected to push domestic demand 2.3 per cent higher in 2024/25 to 30.9 million metric tons result in the causes of inflation in Pakistan.

Pakistan is the eighth leading producer of global wheat production, after China, India, Russia, the United States, Canada, Australia, and Ukraine. Despite the high total yield, Pakistan’s wheat yield is only three tons per hectare, ranking 15th in the world.

As Pakistan wrestles with the entwined encounters of sliding inflation and the wheat procurement fiasco, understanding the dynamics of wheat consumption, bumper crop trends, minimum support price mechanisms, and wheat imports becomes crucial. In this article, we delve into these facets to shed light on the state of agriculture and food security in Pakistan.

The country’s headline inflation has started to slide down and is expected to touch 15 per cent. This has been possible mainly because of a significant drop in wheat and flour prices. However, the alleged and controversial decision to import around 3.5 million tons of wheat in early 2024 can be ascribed to the easing of inflation.

The current year’s bumper wheat harvest of around 30m tons amidst a prior wheat stock has suppressed the market price of wheat, especially for farmers. In an era of the free market economy — supported by many economists and policymakers — the current price reflects supply and demand.

Consumption of Wheat and Bumper Crop of 2024 is a good sign for the Agriculture sector:

Pakistan’s affinity for wheat is deeply ingrained in its culture and diet. With a burgeoning population and a staple-based diet, wheat consumption remains high. The year 2024 witnessed a bumper crop, offering a glimmer of hope in the backdrop of economic uncertainties. The robust yield not only buoyed hopes for food security but also presented challenges in its procurement and management.

Minimum Support Price is a sigh of relief for the Farmers of Pakistan:

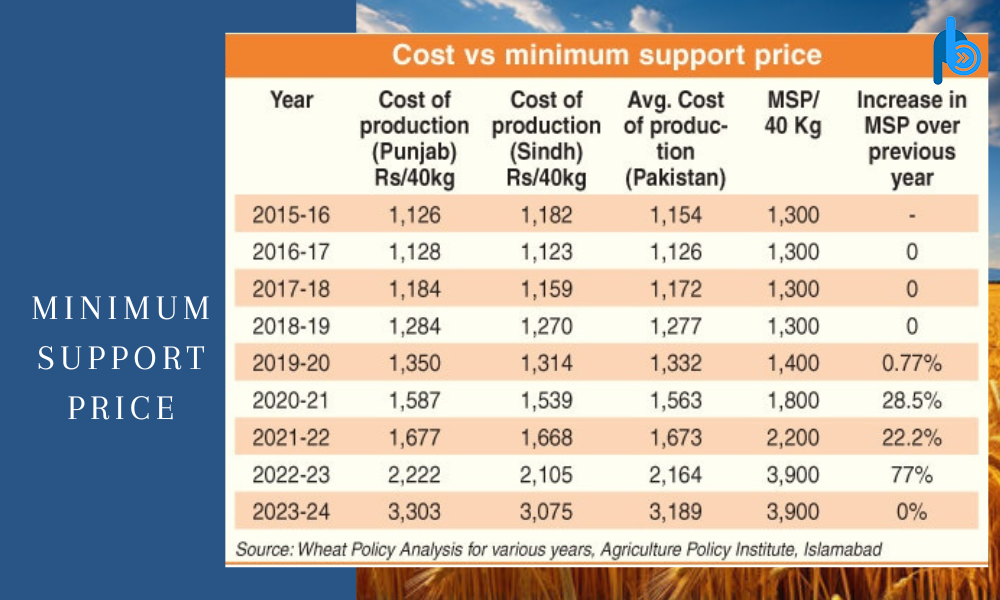

The Minimum Support Price (MSP) mechanism serves as a lifeline for farmers, providing them with a guaranteed price for their produce. However, the effectiveness of MSP implementation often faces scrutiny amidst bureaucratic hurdles and market dynamics. In the context of wheat, ensuring a fair MSP becomes paramount to sustain farmer livelihoods and incentivize agricultural investments.

Considering the price support history for wheat in recent years, an exaggerated support price was announced last year, with a 77pc increase from the previous year, 2021-22. Although the minimum support price (MSP) was raised by 77pc for the year 2022-23, the per 40kg cost of production was reported to increase by 46pc — from Rs2,105 to Rs3,075, as per the Agriculture Policy Institute (API).

Importing of Wheat is for Food security and Low Floor prices:

Despite being an agrarian economy, Pakistan occasionally resorts to wheat imports to bridge the demand-supply gap. Factors such as erratic weather patterns, inadequate storage facilities, and logistical constraints contribute to the need for imports. However, over-reliance on imports poses challenges to food sovereignty and self-sufficiency goals. Balancing domestic production with judicious imports remains a policy conundrum.

Causes of Inflation in Pakistan

Sliding inflation presents a complex puzzle for policymakers, with implications spanning across sectors. In the realm of agriculture, inflationary pressures can distort market dynamics, impacting both producers and consumers. As wheat remains a staple commodity, its price fluctuations directly influence household budgets and macroeconomic indicators. Mitigating inflationary pressures requires a multifaceted approach, encompassing monetary policies, supply chain management, and strategic interventions.

The Wheat Procurement Fiasco and Agriculture Investments

The wheat procurement process in Pakistan has been marred by inefficiencies, bureaucratic red tape, and corruption allegations. Delayed procurement not only affects farmers’ incomes but also jeopardizes food security goals. Addressing this fiasco necessitates structural reforms, transparency measures, and technology integration. Furthermore, robust investments in agriculture infrastructure, research, and development are imperative to enhance productivity and resilience. Under the umbrella of SIFC, FDI of around $10 Billion is expected to be injected in the Agriculture and Food security sector.

Conclusion

The sliding inflation and the wheat procurement fiasco underscore the intricate interplay between agricultural policies, market dynamics, and socioeconomic factors in Pakistan. Balancing the interests of farmers, consumers, and the economy requires concerted efforts from policymakers, stakeholders, and society at large. By addressing systemic inefficiencies, promoting sustainable agriculture practices, and fostering innovation, Pakistan can navigate these challenges towards a more resilient and food-secure future.

Relatable Blog from this Author: