Pakistan’s economic recovery journey is real, and the market is showing remarkable confidence, all the relevant stakeholders are showing confidence that is signaling a path toward consolidation and growth.

As clocking another genuine current account surplus coupled with a significant expansion in YoY exports particularly in the IT sector, remittances, and investor enthusiasm in the stock exchange, there’s a tangible restoration of confidence among investors. The Government’s successful Foreign Policy with economy and foreign investment and trade at its core, has also triggered a sense of productivity and shows that this time we mean business.

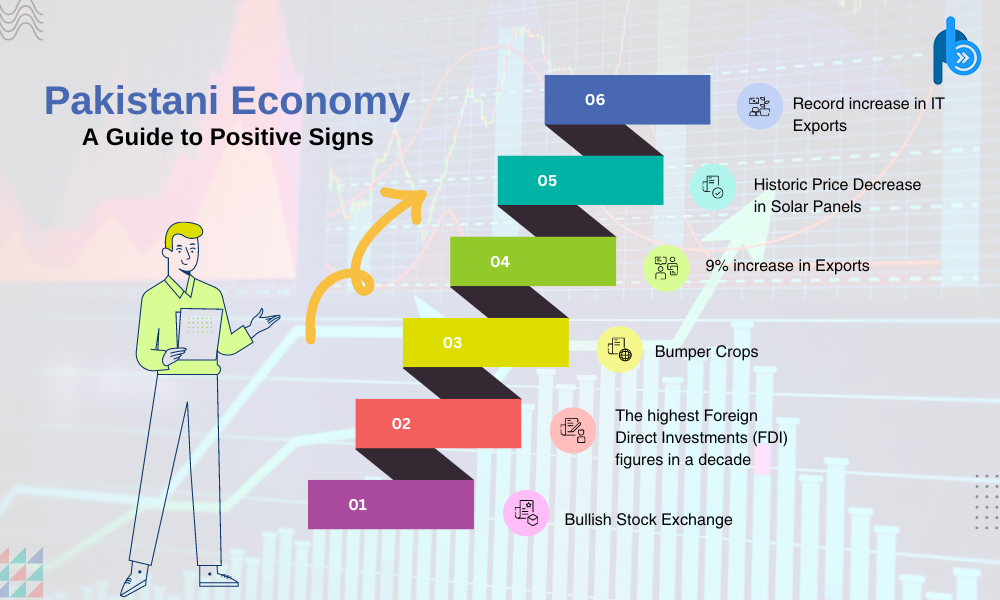

Bullish Stock Exchange

This positive trend reflects a significant turnaround as compared to the last couple of years, the economic indicators portray a more stable and promising economic landscape. Stability in the exchange rate and continued satisfaction of multi Understandingmultilateral international financial institutions particularly IMF and WB on structural reforms also helping to restore hope and triggering growth through genuine investments.

All this has resulted into a streak of Bullishness at the Stock Exchange (PSX) and KSE-100 index stands at its historic height of 73,000 points as of April 29, 2024.

The highest Foreign Direct Investments (FDI) figures in a decade

The Foreign Direct Investment in the month of March stood at $258 million alone, which is the highest FDI made in any single month in the last 09 years.

Bumper Crops

The country is gearing up for a bumper crop of Food grains in sha Allah that will help to bring the inflation down in the coming months as well. As per the report the Food grain exports rose by 48% i.e., $1.83 billion increase YoY.

9% increase in Exports

The Country’s exports saw a 9% increase in the first 9 months of the current Fiscal year, from July till March 24, the total volume of the exports was $22.93 billion and that’s a whopping $1.9 billion YoY increase.

Historic Price Decrease in Solar Panels

The solar panels have decreased by nearly 60% and stand at the lowest in recent history, as per the market sources more reduction in the price is expected which will help to increase the purchasing power of the masses who are struggling with the highest ever Utility prices in history.

Record increase in IT Exports

The net IT exports in March are also higher than the last 12-month average of $208 million. In 9MFY24 net IT exports recorded a growth of 16% YoY to $1.99 billion.

In a recent interview, Finance Minister Muhammad Aurangzeb stated that IT exports are likely to reach $3.5 billion this year.

“Although there has been a growth in gross IT exports during 9MFY24, the government’s target appears challenging. We anticipate that gross IT exports for FY24 will likely fall around $3.0 billion compared to $2.6 billion recorded last year,” read the brokerage note.

Surplus Current Account for the Month of March and a shrinking Financial Deficit

For the month of March 2024, the Current Account was $619 million surplus, the highest since February 2015, and the financial deficit shrinks by $4 billion YoY FY23vsFY24. This is largely driven by increased workers remittances.

Ray of Hope

All these economic indicators are showing that the hard work of the 16 months of the previous PDM Government and the continuity of policies in the Caretaker Government were in the right direction and has provided a base to improve the economy and now once the Foreign Direct Investment and IMF deal is put into place the economy will start to expand.

It’s expected that the SBP will announce a decrease in the interest rate next month that will start the reduction phase of the inflation rate in the Country.

We can end this article on this historic note:

By the end of this year December ’24, the nation will start noticing a reduction in prices of the grocery items coupled with a reduction in the prices of Gas and Electricity.

Let’s hope for the best and share the positivity as this will trigger the economic revival and we all should be vigilant that nobody this time should be allowed to derail this effort of revival of the economy for their petty political gains as this can be a part of the greater game to again create uncertainty to halt the investment under the SIFC by KSA, China, UAE and other friends of Pakistan with business agreement of increasing trade with Iran and Türkiye are also a promising factor that needs political stability in the country. GOOD LUCK!!!